Optimizer0 - Zero-Configuration Portfolio Solution

Get started with Optimizer0

Explore our full range of fintech solutions for MSMEs and individuals.

Discover Our Services →

Find the best portfolio weights with Optimizer0

Moving Block Bootstrap Simulation

Generate realistic future simulations without tracking every transaction

Return Focused Optimization

Minimal trading logic for a straightforward approach to portfolio management

Modern Portfolio Metrics

Metrics inspired by Modern Portfolio Theory for comprehensive insights

About Optimizer0

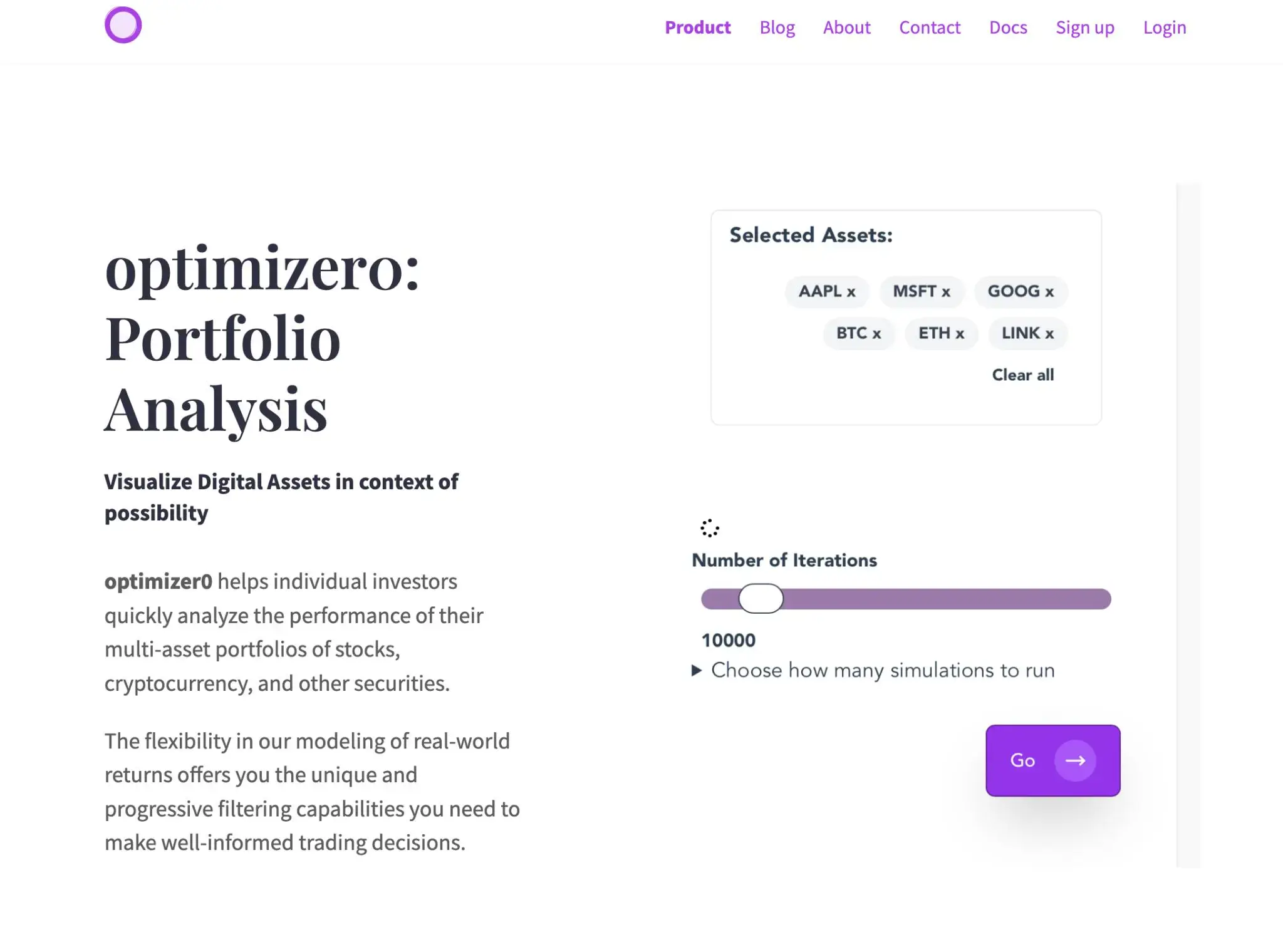

Optimizer0 is a zero-configuration optimization tool that uses a bootstrap approach and sensible defaults for efficient portfolio management.

Zero config

Sensible defaults – simply input a set of assets and let Optimizer0 handle the rest.

Scalable Tooling

Designed to handle hundreds of assets and thousands of simulations, making it perfect for growing portfolios.

Early Beta

Join the early beta program and be one of the first to experience Optimizer0.

Optimizer0 Features

Block Bootstrap

Experience realistic future simulations with our advanced block bootstrap approach.

Return Focused

Our return-focused optimization minimizes trading logic for a streamlined experience.

Modern Portfolio Metrics

Gain valuable insights with metrics inspired by Modern Portfolio Theory.

Quick Start

Easily get started with our user-friendly interface and simple input requirements.

Scalable Tooling

Optimized for scalability, Optimizer0 is designed to handle hundreds of assets and thousands of simulations.

Early Beta

Join our early beta program for exclusive access to new features and improvements.

Get started with Optimizer0

Explore our full range of fintech solutions for MSMEs and individuals.

Discover Our Services →Join waitlist

Get started with Optimizer0 Join our early beta program for exclusive access to new features and improvements.

Discover Our Services →How Optimizer0 Works

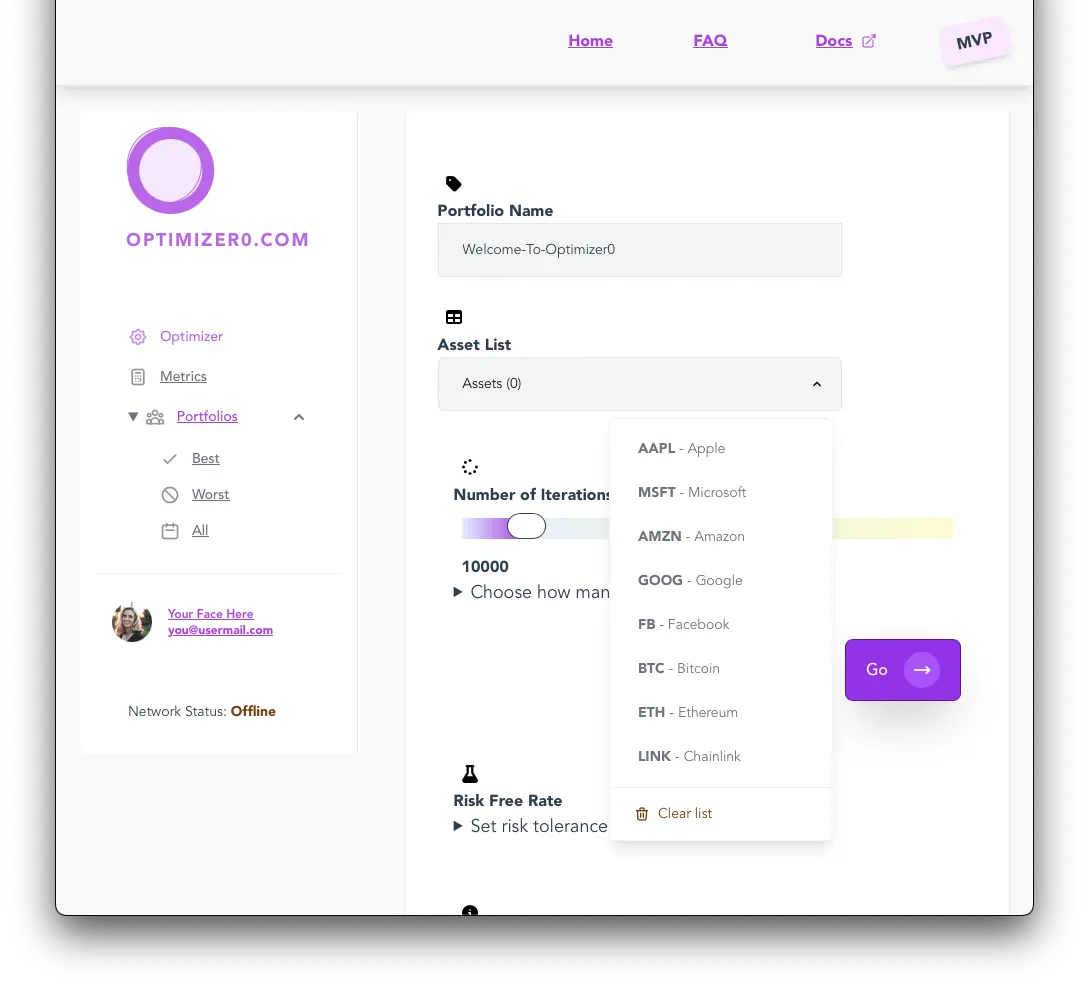

1. Select Assets & Parameters

Choose a list of assets, set a portfolio name, define the number of simulations to run, and optionally set a risk-free rate.

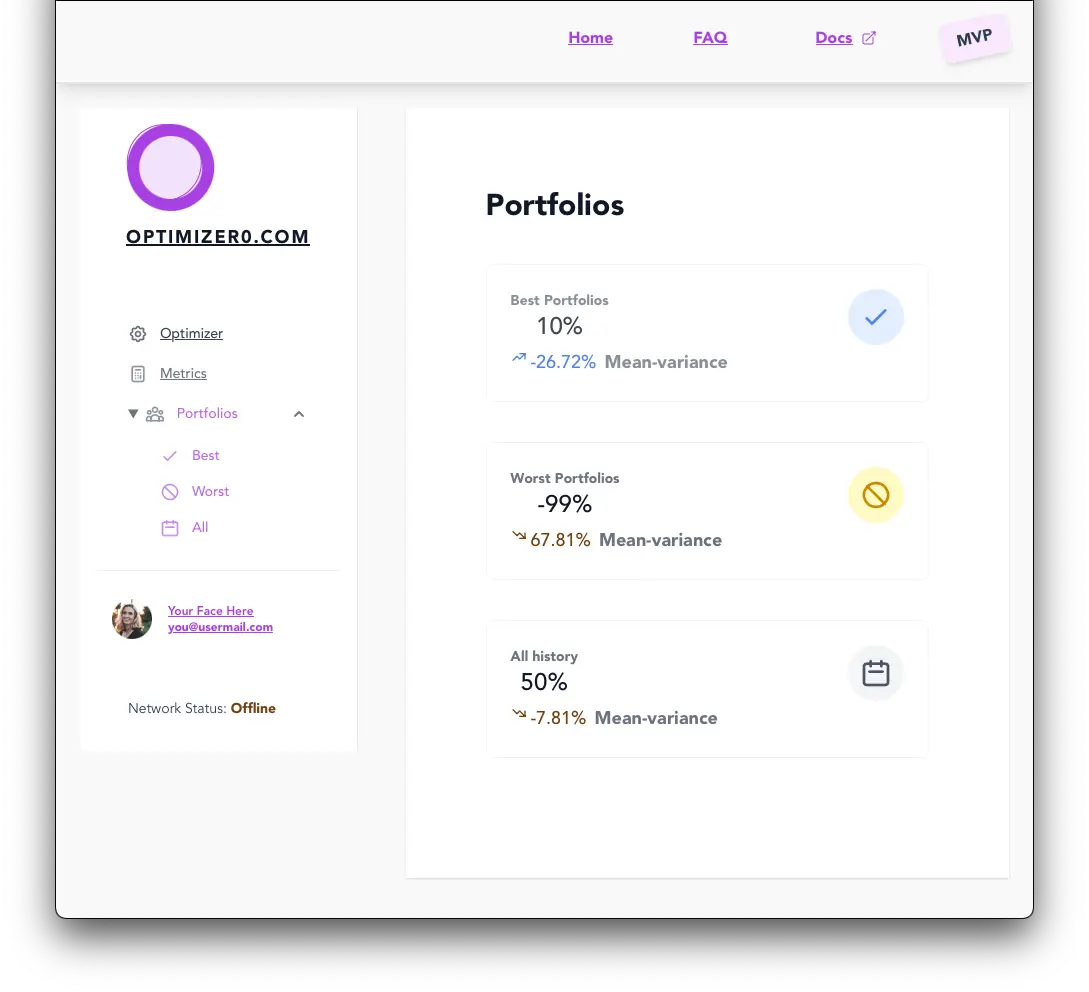

2. Mean Variance Analysis & Efficient Frontier

Receive mean variance analysis and an efficient frontier based on your portfolio's historical data.

3. Run Simulation & Review Results

Select a mean variance/efficient frontier and run a simulation. View charts and metrics for the best and worst portfolio weights alongside historical and simulated data frame prices.

Pricing

Early Beta

Join our early beta program for free access to early features and provide feedback for future improvements.